Text Fraud Explained

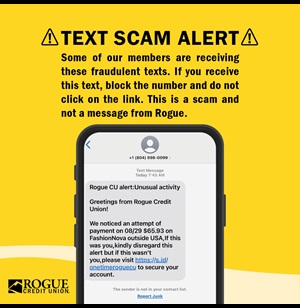

Text fraud is on the rise. Americans lost $330 million to text fraud in 2022 and during that time, the most common form of text fraud involved cybercriminals impersonating banks and credit unions. Here’s how to protect yourself.

- Transaction Confirmation: Asks you to confirm or deny a “purchase” made with “your card” by replying to the text.

- Account Breach: Wants you to click a link or call a “fraud department” to freeze your accounts due to “fraud” on your account.

- Multi-Factor Authentication: Prompts you to open a website, enter a confirmation code or login to an account so they can poach your personal information.

Other scam texts will offer you fake gifts and prizes or notify you of fake package delivery issues.

Don’t take the bait! Regardless of what the text says, don’t share sensitive or personal information.

- Don’t reply to the message: The fraudster will then pressure you for information or try to get you on the phone.

- Don’t click a link: The fraudster will have you download an app or software that contains malware, or they’ll try to grab your account information through a fake website.

- Don’t call any phone numbers: The fraudster will push you to share sensitive information by impersonating a person or organization you trust.

Rogue Credit Union will never reach out to ask for your personal information. If you receive a suspicious text, ignore it. Don’t respond or click included links. If you think the text might be real, ask a team member to verify it: Call us at 800.856.7328, chat with us online or stop by your local branch.

If you’re receiving scam or spam texts, forwarding them to 7726 will alert your wireless provider. You can also notify Apple, Google and the Federal Trade Commission.

If you’re a victim of text fraud or suspect that you have shared sensitive information with a scammer, call us at 800.856.7328. We’ll help you find a path forward.

At Rogue Credit Union, we take the safety and security of our members’ accounts very seriously. If you have any questions or suspect fraudulent activity on your account(s), we’re here to help. Give us a call at 800.856.7328, chat with us online or stop by your local branch