FICO® Scores are the most widely used credit scores. Staying on top of your FICO® Score can help you get better loan rates, credit cards with special benefits and more! As a member of Rogue Credit Union, you have free access to your FICO® Score through Online and Mobile Banking. Checking Your FICO® Score is free and will not impact your credit.

Online Banking: Hover over “Additional Services” in the main navigation bar, then click “Check your FICO® Score” from the drop-down list.

Mobile Banking: Go to “More,” then scroll down and tap “Check your FICO® Score.”

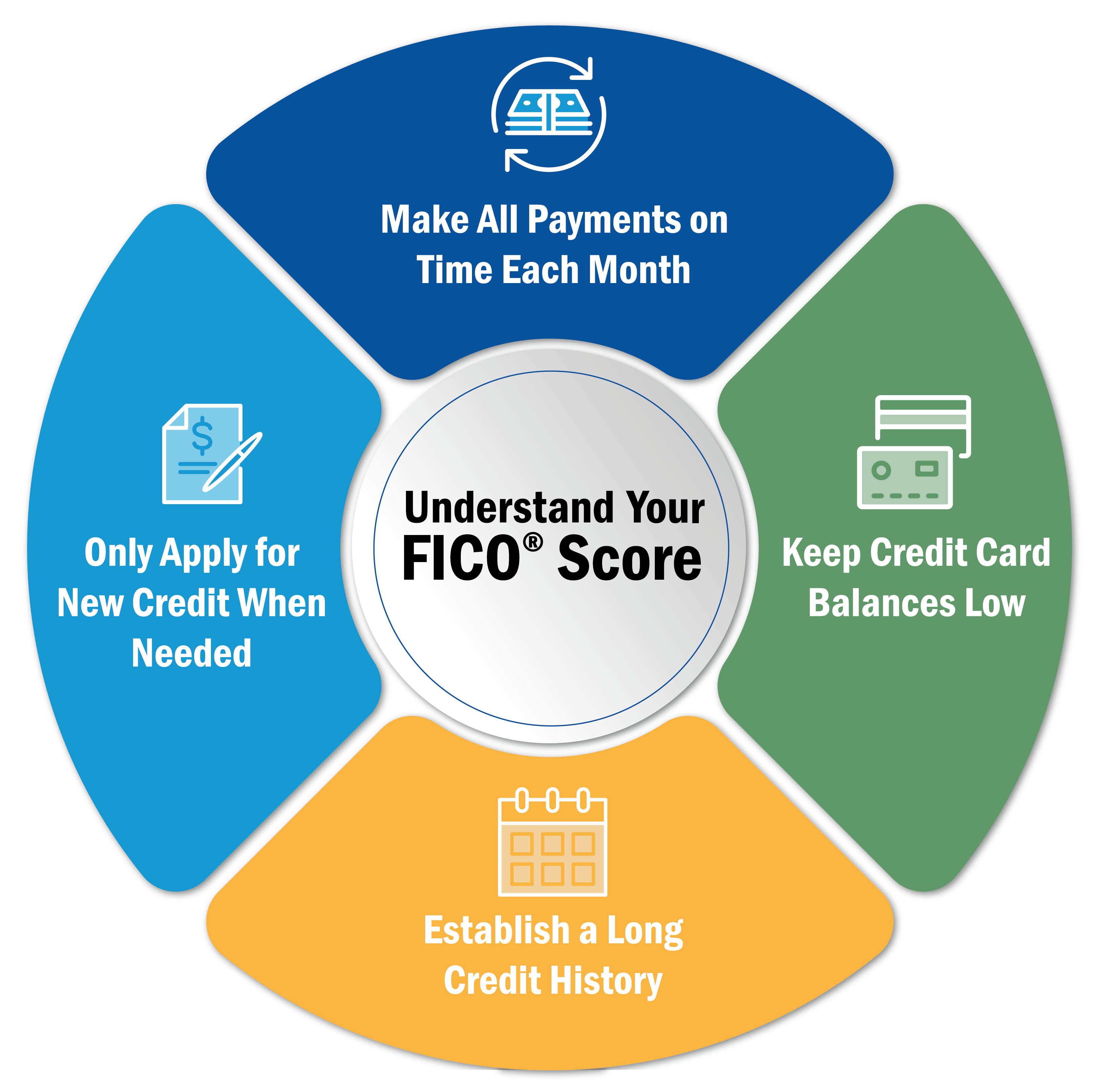

Grow Your FICO® Score

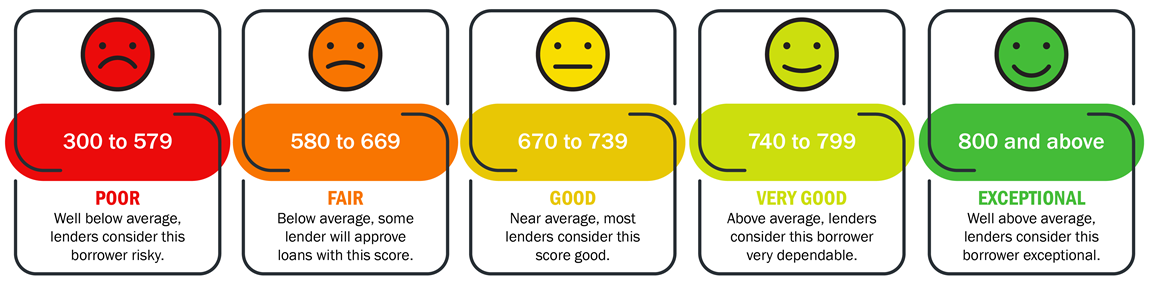

The better your score, the more likely you are to receive competitive terms on loans and more.

What is a FICO® Score?

Each FICO® Score is a three-digit number calculated from the data on your credit reports at the three major consumer reporting agencies: Experian, TransUnion and Equifax. FICO® Scores predict how likely you are to pay back a credit obligation as agreed. Lenders use FICO® Scores to help them quickly, consistently and objectively evaluate potential borrowers' credit risk.

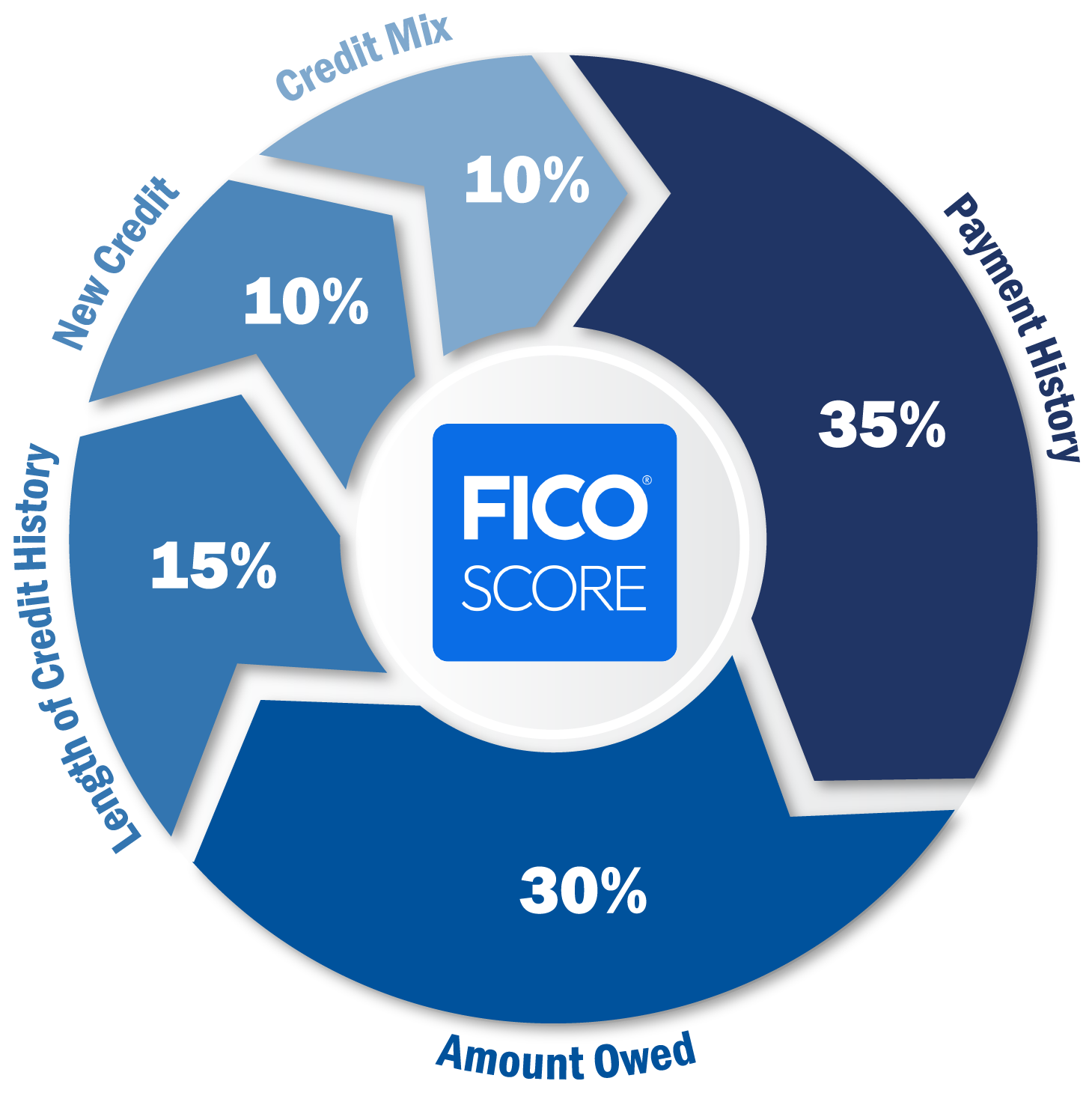

How is a FICO® Score Calculated?

There are five factors that determine your FICO® Score:

• Payment History: Whether you've made past payments on time

• Amounts Owed: Amount of credit and loans you are using

• Length of Credit History: How long you've had credit

• New Credit: Frequency of credit inquiries and new account openings

• Credit Mix: Mix of your credit, retail accounts, installment loans, finance company accounts and mortgage loans