Federal Student Loan Repayment Programs

Learn more about student loan repayment with this video.

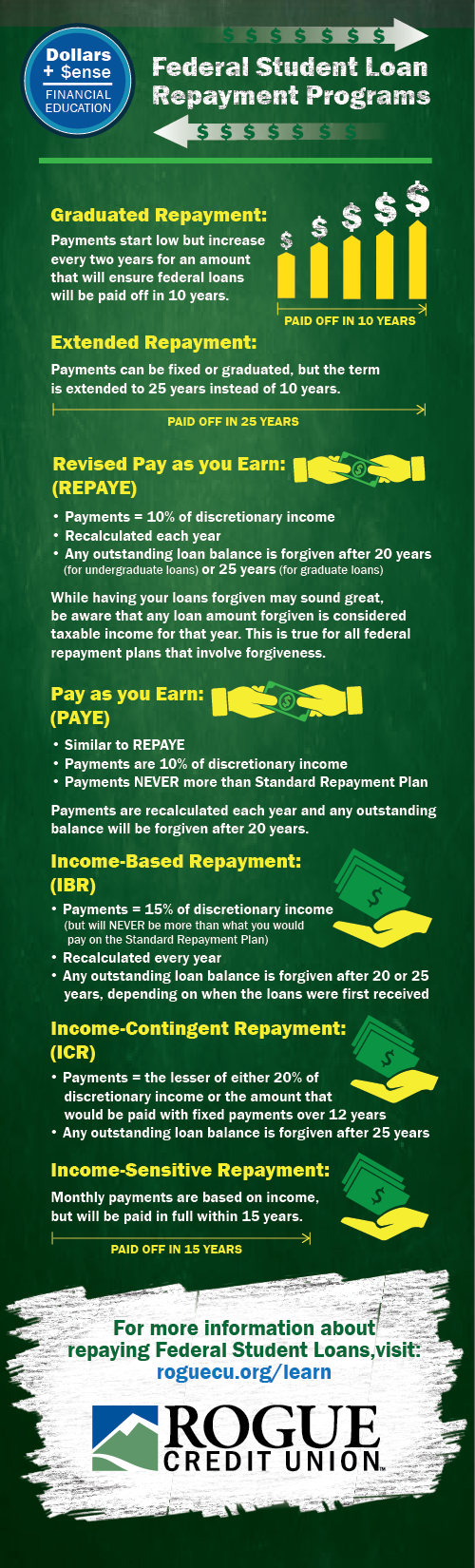

Federal Student Loan Repayment Programs

Graduated Repayment: Payments start low but increase every two years for an amount that will ensure federal loans will be paid off in 10 years.

Extended Repayment: Payments can be fixed or graduated, but the term is extended to 25 years instead of 10 years.

Revised Pay as you Earn (REPAYE): Payments will be 10% of discretionary income and are recalculated each year. Any outstanding loan balance will be forgiven after 20 years (for undergraduate loans) or 25 years (for graduate loans). While having your loans forgiven may sounds great, be aware that any loan amount that is forgiven will be considered taxable income for that year. This is true for all federal repayment plans that involve forgiveness.

Pay As You Earn (PAYE): Similar to REPAYE, payments will be 10% of discretionary income but will NEVER be more than what you would pay on the Standard Repayment Plan. Payments are recalculated each year and any outstanding balance will be forgiven after 20 years.

Income-Based Repayment (IBR): Payments will be 10% - 15% of discretionary income, but will NEVER be more than what you would pay on the Standard Repayment Plan, and are recalculated every year. Any outstanding loan balance will be forgiven after 20 or 25 years, depending on when the loans were first received.

Income-Contingent Repayment (ICR): Payments will be the lesser of 20% of discretionary income or the amount that would be paid with fixed payments for 12 years. Any outstanding loan balance will be forgiven after 25 years.

Income-Sensitive Repayment: Monthly payments are based on income, but will be paid in full within 15 years.