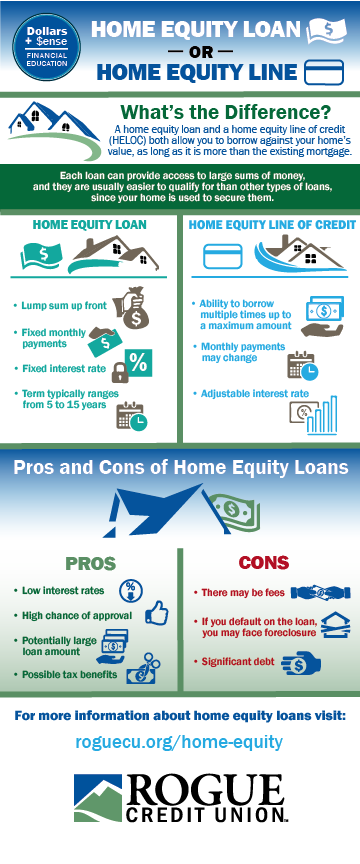

Home Equity Loan vs. Home Equity Line of Credit

Learn more about how to access the equity in your home using a home equity loan or home equity line of credit (HELOC) with this video!

What is the difference between a Home Equity Loan and Line of Credit?

Both Home Equity Loans and Home Equity Lines of Credit (HELOC) allow you to borrow against your home’s value, as long as the value of the home is more than the existing mortgage. They can provide access to large amounts of money, and are usually easier to qualify for than other types of loans, as you are using your home to secure the loan.

Home Equity Loan

- Lump sum upfront

- Fixed monthly payments

- Fixed interest rate

- Term typically ranges from 5 to 15 years

Home Equity Line of Credit

- Ability to borrow multiple times, up to a maximum amount.

- Monthly payments may change

- Adjustable interest rate

Pros and Cons of Home Equity Loans

Pros

- Lower interest rates

- Higher chance of approval

- Potentially large loan amount

- Possible tax benefits

Cons

- There may be fees during the application process

- If you default on your loan, you may face foreclosure

- Significant debt